We invited three advocates to share their preferences and ideas for what the state's lawmakers should do in the face of rising costs and tight revenues. And now, Bill Hammond of the Texas Association of Business, Talmadge Heflin of the Texas Public Policy Foundation, and Eva DeLuna Castro of the Center for Public Policy Priorities.

There's something to be said for leaders in the Texas Legislature sticking to their guns and releasing a state budget that keeps spending within existing revenues.

To my friends in the House and Senate, I say: We must continue to fight to ensure that we implement cost-saving reforms that reflect Texas' commitment to economic growth. But our current budget shortfall isn't a time to be penny-wise-and-pound-foolish.

The state will have $72.2 billion available for general-purpose spending during the 2012-13 biennium, leaving a $15 billion gap from the current general revenue spending of $87 billion. How do we close this gap? It will take grit and courage to address the shortfall without raising taxes, creating new fees or increasing existing ones. Difficult? Yes. Doable? Absolutely.

First, let's hold the line on general revenue spending at its current level of $87 billion for the biennium. Next, while the sky isn't falling, it sure is raining. So let's have the courage to tap the Rainy Day Fund for $6 billion, a prudent and appropriate action.

To control health care costs, one simple fix is to remove a loophole that allows the Rio Grande Valley to effectively opt-out of Medicaid managed care. This single change — expanding Medicaid managed care statewide — would result in $1.2 billion in savings.

We need efficiencies in government, including education where smart budgeting and reforms will offer a significant return on our investment by way of an educated, skilled workforce.

We've worked hard to raise high standards for students in pre-kindergarten through high school. To that end, we must use the Available School Fund for its constitutionally intended purpose—student textbooks and instructional materials, including technology. Budget writers should prioritize $550 million of the fund for digital and print materials for pre-kindergarten, English as a second language, writing and science,--all of which are due to classrooms this fall.

We could also use more of the $1.9 billion Available School Fund to restore programs eliminated in the base budget that have had proven success in improving education in Texas. Among these strategic investments are a $270.9 million technology allotment; $223.3 million for pre-kindergarten programs that provide a solid foundation for our youngest students; $385.1 million for incentive pay for our school's most outstanding teachers; $51 million for proven secondary level strategies that will improve post-secondary readiness and graduation rates; and $20.3 million for the virtual school network.

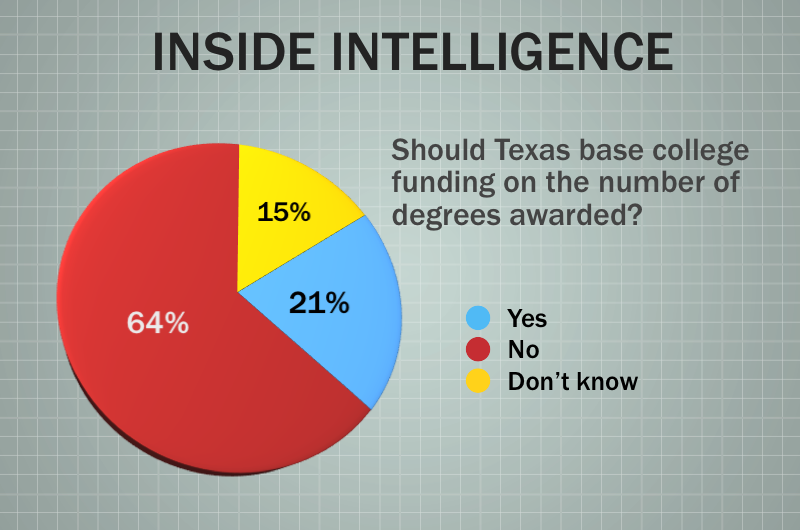

There's also a case to be made for fully funding effective, efficient state programs in public and higher education that are critical to our State's long-term competitiveness and prosperity. I'd argue for the TEXAS Grants program to be kept at current spending levels, while making reforms to ensure greater productivity. We must graduate more students with degrees or post-secondary credentials, and a priority-based TEXAS Grants program that remains fully funded will certainly help us get there. Higher education funding should be kept level too, but let's demand better performance by requiring 10 percent of higher education funding to be based on completion rates.

Plenty more opportunities exists to make strategic cuts, accounting tweaks and smart updates to state law to get us to the $87 billion budget target.

For one, let's go ahead and delay the date of payments by the State by one day into the next fiscal year, a useful tactic used when Texas last faced a significant budget crunch in 2003. This simple action could save the State $3 billion to $4 billion alone.

While we don't have to expand the gambling footprint, we can and should pass legislation to allow slot machines at existing Texas horse and dog racetracks and Native American Indian reservations. These machines would generate as much as $850 million in direct state tax revenue during the current biennium and nearly $1 billion per year at full implementation.

We can pass legislation that requires probation with mandatory treatment for first-time, low-level drug possession offenders with no prior violent, sex, property or drug delivery crimes, allowing for an estimated $500 million savings by 2012.

As for the remaining $2.5 billion, it's reasonable to consider some of the thoughtful recommendations laid out in recent days by organizations like Texas Higher Education Coordinating Board, the Texas Public Policy Foundation and Texas Conservative Coalition Research Institute.

What I have set forth could best be summed up as a rational proposal for budgeting. Let's make strategic cuts and responsible investments that will ensure our state's continued prosperity.

Bill Hammond is President and CEO of the Texas Association of Business. He served four terms in the Texas House of Representatives.

Austin insiders say that additional revenue is needed to close the state's projected multi-billion dollar budget shortfall. Without the extra income, they claim, lawmakers risk the state's future fiscal health and prosperity. But is that really the case? Is more money the only viable solution?

Of course not. Just as anyone managing a household budget knows, when a family's expenses grow beyond its income, the solution is not to instantly drain your savings and demand a raise from your boss. The proper response is to cut back on household expenses — particularly if your family's spending habits resemble anything close to the state's.

According to the Legislative Budget Board, state government spending increased by nearly 300 percent between fiscal years 1990 and 2010, or 139 percent after adjusting for inflation. During the same period, Texas' population grew by only 49 percent. Considering this kind of spending trajectory, it is little wonder that Texas' finances have gotten out of whack. Maintaining this level of expenditure growth is not sustainable, and lawmakers must now make reasonable adjustments on the spending side of the state's ledger.

Now the hard part: If the most sensible solution to the state's fiscal woes is reducing spending, which areas of the budget should the Legislature prune?

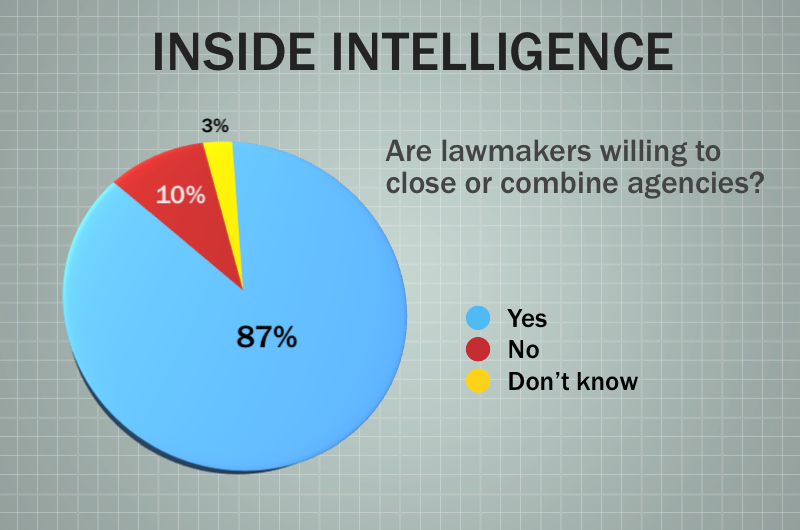

In short, there should be no "sacred cows" this session: Every expenditure must be on the table. But we should focus particular attention on getting government out of doing things that individuals or the private sector can take care of themselves, such as promoting tourism, history and the arts, or determining how much consumers should pay for electricity, telephone service or insurance.

Likewise, there are a lot of things we can do without for a biennium (or two) while we try to get our fiscal house back in order. We can postpone the purchase of new parks, delay renovations of historical properties and get by without some recent and expensive environmental and health care spending.

We also need to think big. Health care and education spending dominate the budget, and if we are going to successfully tackle the shortfall, we need to look at ways to stretch our dollars further in these areas.

For example, lawmakers should consider such policy options as expanding Medicaid managed care, creating a health savings account option for state employees, cutting back all optional health programs to federally required levels, reducing university formula funding across-the-board and giving school districts the tools and the prodding to curb administrative bloat in K-12 education.

Finally, the Legislature should consider significantly paring back, if not altogether eliminating, state economic incentives and subsidies. If our low taxes, limited and predictable regulations, right to work laws and civil justice system aren't enough to make Texas attractive to some businesses, that would suggest they're the type of rent-seeking transients Texas can do without.

In conjunction with these budget reduction options, lawmakers should also take care not to tap the state's rainy day fund or resort to accounting gimmickry.

First, it is important to realize that one-time measures and spending sources should not be used to support ongoing obligations. If your family's budget is consistently exceeding its bounds, no reasonable person would advocate that you raid your savings account to enable day-to-day spending. This only prolongs the root problem of excessive spending.

Perhaps more importantly though, this session does not appear to be the state's only difficult budgeting cycle. According to research we published last month, "Final Notice: Medicaid Crisis," Medicaid costs before ObamaCare will double every 10 years through the next three decades. ObamaCare adds 3.1 million people to Texas' Medicaid rolls by 2014, and Texas will need an additional $10 billion in the next budget to meet those costs. The state will need to preserve as much of its financial flexibility for as long as possible to help avoid future fiscal crises.

Holding the line on government spending is never easy; it is far more satisfying to give than it is to take. But in today's economic climate, the reality is that we can no longer afford the level of government spending we have had in the past. Spending must be brought in line with income, not the other way around.

Talmadge Heflin is Director of the Center for Fiscal Policy at the Texas Public Policy Foundation, a non-profit, free-market research institute based in Austin. He served 11 terms in the Texas House of Representatives and chaired the House Appropriations Committee in 2003, when the state had a $10 billion budget shortfall.

Budget hearings have been underway for only a few days, but it's already clear that $72 billion in General Revenue won't be nearly enough to meet the needs of Texas. Instead of cutting down to the revenue estimate, the 82nd Legislature must take a balanced approach that uses our reserves and adds revenue. And we have to start by casting aside wishful thinking; we are writing the 2012-13 budget, with higher costs and increased enrollment in education and health care services — not some past budget. (In fact, the 2006-07 budget is the most recent one that could be covered with $72 billion in General Revenue. That's also the last budget before $14 billion in local property tax reductions were added to the state appropriations act; more on this later.)

Future needs — what's called "current services" levels — require at least $99 billion in General Revenue. With only $72 billion available, the revenue shortfall endangering state services is $27 billion. That $99 billion does not include any "wish list" items. Agencies requested almost $107 billion in General Revenue to expand or improve state services, but only current services costs for education, health care, and prisons are included the $27 billion shortfall calculation.

So what's the right way to close a 27 percent gap in one of the lowest-spending, lowest-taxing states in the nation? What options do we have that won't send the Texas economy into a tailspin?

Use the Rainy Day Fund: all $9.4 billion. It's officially called the Economic Stabilization Fund for a reason. State budget cuts could easily lead to layoffs of more than 100,000 school district employees, costing another 140,000 private sector jobs. Can the Texas economy afford to lose a quarter of a million jobs? Legislators overwhelmingly agreed that tapping the fund was the right thing to do in 2005 (HB 10, Pitts), 2003 (HB 7, Heflin) and earlier sessions when it was raining nowhere near as hard as it is now.

Smoke and mirrors: $5 billion. Delaying July-August 2013 payments to school districts could push $3.5 billion in costs into fiscal 2014 and buy much-needed time to see if state revenue recovers faster than is currently forecast. Yes, this could cause a few school districts some cash flow problems, but not as much as the almost $10 billion cut to the Foundation School Program proposed in the House budget draft. Where possible, postpone one month of payments to Medicaid and other providers, along with other large payments to non-GR accounts and pension systems, or speed up collections of General Revenue so they happen in 2013. Anything that buys time and can be undone in the future is preferable to cuts today. (Note: This does not include cutting low-income utility assistance and other services funded by dedicated General Revenue to help certify the budget; those go in the category of "cuts today").

New revenue options: $12.5 billion. Enforce existing tax laws ($500 million). Enact a hospital quality assurance fee ($350 million) to help match federal Medicaid dollars. Eliminate or reduce outdated tax breaks — for example, the high-cost-natural-gas exemption ($2.3 billion a biennium) and the sales tax timely filer/prepayment discounts ($150 million). Enact a Healthy Texas Tax Bill that boosts the cigarette tax by $1 a pack ($1.5 billion biennially), taxes sugar-loaded drinks ($2.5 billion biennially) and raises taxes on beer ($100 million) and other alcoholic beverages. Expand the sales tax to cover certain business and professional services ($5 billion).

What should we do beyond the session? Part of the revenue shortfall is due to the Great Recession. The recession will be temporary, so the revenue losses it caused can be replaced with the Rainy Day Fund or "smoke and mirrors." But the Legislature must also plug the hole caused by 2006's school property tax cuts. The structural deficit caused by the failure of franchise tax changes to generate anywhere near the local tax revenue lost by school districts has created a $10 billion biennial hole in the state budget. Permanent structural changes (such as closing the high-cost gas tax loophole or expanding the sales tax base) will be needed to fix this structural deficit. If we don't take a balanced approach now, our longer-term problems will be that much harder to solve.

Eva DeLuna Castro has been a budget analyst at the Center for Public Policy Priorities since 1998. She worked as a researcher and writer at the Comptroller's office for six years.